September 22, 2025

A strategy BaaS can reduce operational steps, but it depends on regulatory requirements, testing, approvals, and authorized partners. Roadmaps, technical dependencies, and limits of liability must be carefully planned to ensure safety, compliance, and scalability.

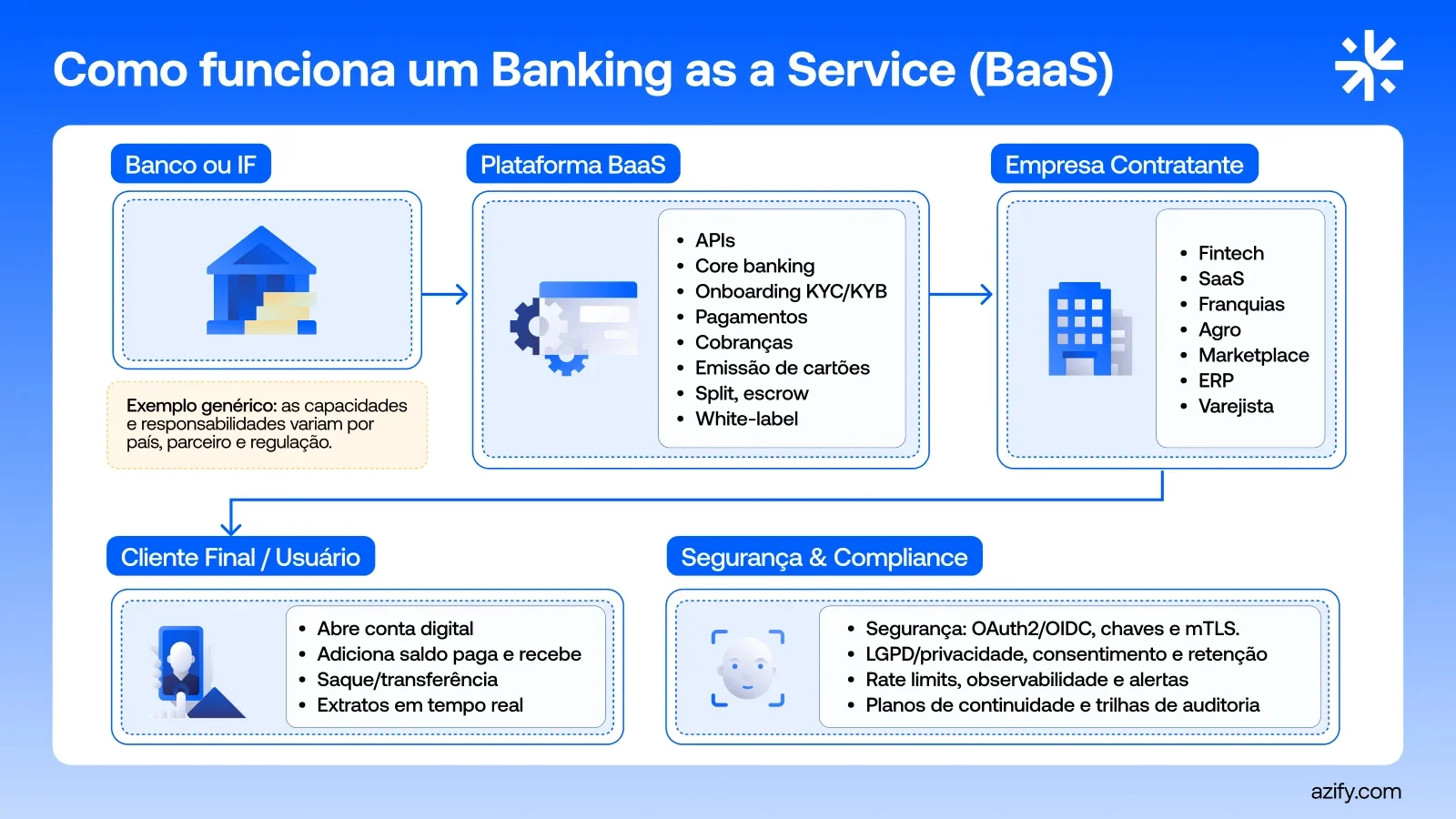

What is BaaS and how does it work?

The Banking as a Service (BaaS) is a model that allows companies from various sectors to integrate financial services without needing to create their own banking infrastructure. In practice, BaaS acts as a technological layer that connects companies to licensed banks, offering functionalities such as opening digital accounts, issuing cards, processing payments, and managing compliance.

The main difference in relation to traditional banks is that while a bank needs to create all the internal infrastructure to offer financial products, BaaS allows fintechs or companies to outsource these services in a modular and scalable way.

In Brazil, companies like Nubank, Mercado Pago and PicPay have adopted BaaS solutions to quickly and securely launch digital accounts and credit cards.

How does BaaS accelerate the launch of financial products?

Fintechs and companies that use BaaS can reduce operational steps and launch products in a more agile manner. This is especially relevant in competitive markets, where time to market is a strategic differentiator.

Cost reduction and operational complexity

By outsourcing infrastructure and compliance, companies reduce costs related to licensing, IT, and specialized teams. This allows the focus to be on customer experience, product design, and innovation, instead of complex internal processes.

Scalability without proprietary infrastructure

With ready-made APIs and modules, fintechs can rapidly expand services, serve more customers, and diversify products without the need to invest in servers, payment processing, or banking licenses.

The Mercado Pago, for example, uses BaaS to offer digital accounts and corporate cards to small businesses without operating as a bank directly.

Informative content. It does not constitute an offer of securities, exchange services, or payment. Past performance does not guarantee future results. Azify operates directly or through duly authorized partners, as per the scope. Evaluate risks, accounting, and tax impacts with your advisors.

What are the key elements to accelerate the launch?

The adoption of Banking as a Service (BaaS) can significantly reduce the time needed to launch new financial products in the market. This happens because the model combines modular technology, ready-made infrastructure, and regulatory processes built in from the start. Among the main elements that allow for this acceleration are:

The APIs (Application Programming Interfaces) are the heart of BaaS. They enable companies to connect their own systems — such as applications, ERPs, or e-commerce platforms — to financial services offered by partner banks or authorized institutions. This modular integration facilitates the addition of functionalities like digital accounts, instant payments, and card issuance without the need to build all the infrastructure from scratch. In addition to saving time, APIs reduce the occurrence of operational errors and offer greater scalability as the volume of transactions grows.

Another decisive factor to accelerate launches is the presence of embedded compliance. BaaS platforms often integrate essential processes such as:

KYC (Know Your Customer) → customer identity verification.

AML/CFT (Anti-Money Laundering and Counter-Terrorism Financing) → controls that monitor suspicious operations.

Audits and regulatory reports → delivered automatically to meet legal requirements.

By offering these mechanisms natively, BaaS reduces the regulatory burden on fintechs and other companies, which no longer need to set up complex compliance departments from the beginning. This does not eliminate the need for legal oversight, but it ensures a solid foundation that speeds up market entry.

The BaaS is already being applied in different fronts to accelerate the creation of financial products. Some common examples include:

Digital accounts for customers or employees: allow offering tailored payment solutions, such as payroll accounts or digital wallets integrated with corporate benefits.

Credit or debit cards with personalized branding: companies can quickly launch co-branded or white label cards, strengthening the brand with the public.

Instant payments and integrated transfers: integrations with Pix and other payment systems reduce operational costs and enhance competitiveness against traditional banks.

These examples show how the combination of pluggable APIs + integrated compliance + ready-made modules creates an ecosystem where launching a new financial product can take weeks, not years, as in traditional models.

What regulatory standards are essential for BaaS?

The adoption of Banking as a Service (BaaS) in Brazil requires attention to a set of regulatory norms that ensure legal security, transparency, and consumer protection. Companies that use or offer this model must observe different layers of regulation:

Central Bank of Brazil (Bacen) → responsible for supervising financial and payment institutions. If the operation involves opening accounts, issuing cards, transfers via Pix, or credit, it is essential that the provider operates under its own license or in partnership with institutions authorized by Bacen.

Brazilian Securities and Exchange Commission (CVM) → when the product or service relates to securities (such as investments, funds, or structured operations), the CVM establishes specific rules for registration, information disclosure, and investor protection.

Law 14.478/2022 (Legal Framework for Cryptocurrencies) → although aimed at virtual assets, this law reinforces the need for transparency and internal controls in digital financial operations. For BaaS solutions that integrate crypto services or open banking, it is essential to assess the implications of this legislation.

General Data Protection Law (LGPD) → essential in any digital financial operation, the LGPD establishes rules for the treatment, storage, and sharing of personal data. This includes policies for consent and cyber security practices to prevent leaks or unauthorized access.

In addition to the formal compliance with regulations, there are good governance practices that strengthen the credibility of BaaS providers in Brazil:

Regular audits → ensure that internal processes are compliant and allow for the proactive identification of failures.

Continuous monitoring of transactions → helps in identifying suspicious patterns and combating money laundering.

Fraud prevention mechanisms → use of artificial intelligence and behavior analysis to protect clients and companies from fraudulent operations.

Segregation of duties → clear separation between technical, financial, and compliance areas, reducing risks of conflicts of interest.

More than just meeting legal requirements, providers and companies that adopt BaaS need to internalize the logic of compliance by design: structuring their services with regulatory compliance and security as a central part of the architecture.

Informational content. It does not constitute an offer of securities, exchange, or payment services. Past profitability does not guarantee future results. Azify operates directly or through duly authorized partners, according to the scope. Evaluate risks, accounting and tax impacts with your advisors.

What steps are essential when planning a product with BaaS?

Adopting a Banking as a Service (BaaS) model paves the way for companies to launch financial products quickly and at scale. However, transforming this opportunity into concrete results requires structured planning and attention to technical and regulatory aspects. Several steps are essential:

1. Evaluation of partners and suppliers

The success of any BaaS-based solution depends on the solidity of the chosen provider. It is essential to verify:

Licensing and regulatory history: confirm whether the operation occurs directly or through partners duly authorized by the Central Bank and other competent bodies.

Security and compliance: ensure that robust KYC (Know Your Customer), AML/CFT (Anti-Money Laundering and Combating the Financing of Terrorism), and LGPD policies are embedded in the model.

APIs and technical support: assess whether the infrastructure offers well-documented, stable, and easily integrable APIs, along with specialized support available for testing and incidents.

SLA and contingencies: clear service level agreements, with uptime guarantees and contingency plans in case of failures, are crucial for maintaining stable operations.

2. Product planning and launch roadmap

One of the major advantages of BaaS is its agility, but this is only achieved with a clear roadmap:

Definition of functionalities: list which services will be offered (digital accounts, cards, payments, credit, multi-currency exchange) and in what order they will go into production.

Integration with internal systems: ensure compatibility with ERPs, CRMs, and other systems already used by the company.

Testing and compliance validation: validate end-to-end flows, ensuring that integrations comply with regulatory standards from the start (compliance by design).

3. Essential metrics and KPIs

To measure success and continuously adjust operations, some metrics are indispensable:

Implementation time: the shorter it is, the greater the competitive advantage in time to market.

KYC approval rate: an indicator of onboarding efficiency and the balance between security and user experience.

Volume of transactions processed: measures the scalability of the infrastructure and its ability to support growth.

End customer satisfaction: assessed through NPS or usability surveys, reflects the product's alignment with market expectations.

What are the new services and monetization models?

The BaaS is evolving to offer open banking, digital wallets, cryptocurrencies, and integrated payment solutions. Monetization models include subscriptions, transaction fees, and partner commissions.

How does open innovation influence growth?

Partnerships between fintechs, banks, and BaaS platforms enable co-creation of financial products, quickly testing market hypotheses and scaling solutions without building entire infrastructure from scratch.

The Banking as a Service (BaaS) provides fintechs and companies from various sectors with an agile, scalable, and secure way to launch financial products, maintaining regulatory compliance and efficient governance. With APIs, ready-made modules, and integrated compliance processes, it is possible to reduce time to market and operational costs without compromising security and customer experience.